The year 2013 was mostly positive for those within the European travel and tourism industry. With the statistics having been released for the first three-quarters of the year, the European Travel Commission Market Intelligence Report reveals that the preliminary results point to a strong performance that is said to be “well above” Europe’s long-term trend.

Here is a look at some of the trends and predictions within the travel and tourism industry in Europe.

Trends

In 2013, international tourist arrivals increased by 5% with a record of over 1.08 million, according to the most recent UNWTO World Tourism Barometer. Despite global economic challenges, international tourism results were significantly better than projected with an additional 52 million international tourists traveling the world in 2013. Europe was one of the strongest destinations for international tourism, with a rate of 5% growth, following Asia and the Pacific, and Africa, which each experienced +6% growth. Central and Eastern Europe was a leading sub-region with +7% growth.

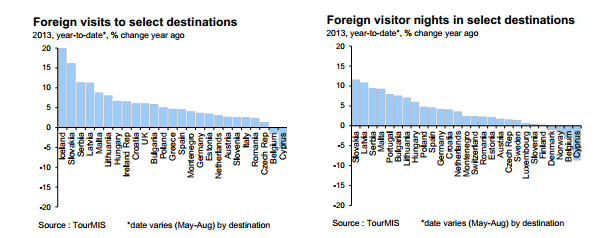

Of the 32 European destinations reporting foreign visits between peak tourism months of May through August, the U.K. reported one of the strongest performances at +6%, followed by Spain at +5%, Germany at +4%, and Austria and Italy both reporting +3%.

Europe welcomed an additional 29 million international tourists in 2013 which was double the region’s average for the period between 2005 and 2012; particularly remarkable considering the regional economic situation which also follows a robust 2011 and 2012. The best results were seen in Central and Eastern Europe at +7%, with Southern Mediterranean Europe at +6%.

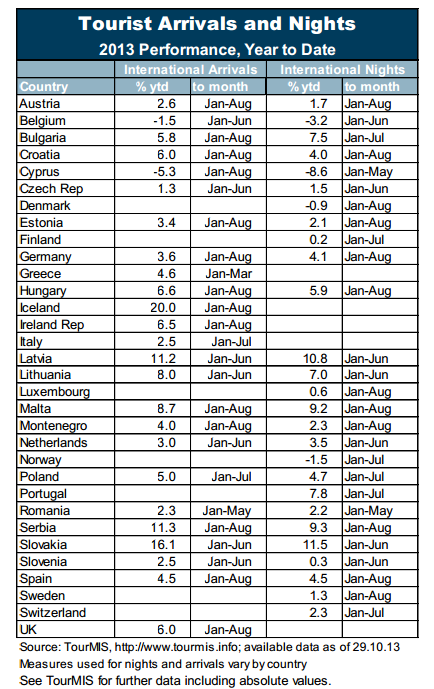

While countries in Eastern and Central Europe continue to be trendy destinations, including Latvia, Serbia and Slovakia, growth is now reportedly being shared by several Western European destinations that have taken advantage of strategic global campaigns. Ireland, which experienced +7% growth, is said to have reaped the benefit of “The Gathering Ireland,” which targeted 70 million people of Irish descent from around the globe. Germany, which experienced a growth of +4%, consolidated growth through a theme year that focused on young travelers.

The coordination between tourism and aviation, involving route expansion was said to be a crucial turning point for destinations like Malta at +9%, Croatia at +6% and Portugal at +8%. Destinations that experienced subdued growth such as Estonia at +3% and Finland at .2% were thought to be due to reduced accessibility from key markets.

2013 Tourism Performance Summary

Of the 25 European destinations that reported inbound travel trends through at least May of 2013, 23 reported higher arrivals as compared to 2012, although the picture is not all positive. Some of the larger markets saw improvement during the summer months, including Spain, the U.K. and Italy. While Iceland, Slovakia, Serbia, Latvia and Malta were among the top five, Cyprus stood out at the bottom, with a significant drop in arrivals as compared to the previous year, particularly around the time of the financial crisis.

.

Long-term forecasts see increasing growth

The UNWTO forecasts international arrivals to rise by 4 to 4.5% in 2014, which is above the long-term forecast of 3.8 percent growth per year between 2010 and 2020; however, the largest growth is expected to be within Asia and the Pacific at 7.7%, followed by the Middle East at 6.7% and the Americas at 5.1%. Within the EU and non-EU countries there is expected to be an average of a 4.5% increase.

Air-Transport Trends

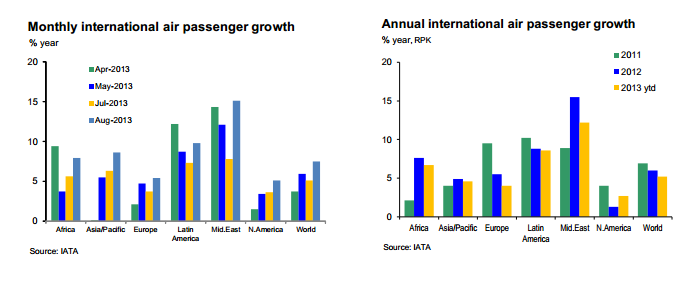

Global air travel increased during the summer months, although growth remains lower than longer-run trends. From June through August, passenger demand increased by 6.2% over 2012, a significant acceleration from the previous three months of 2013.

European international airline demand specifically, has also increased although the growth is said to be somewhat uneven, with a slowdown in mid-fall. Long haul travel exceeded demand, although domestic demand fell throughout 2013.

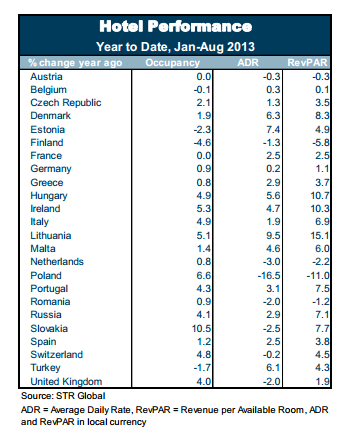

European Hotel Demand: January through August 2013

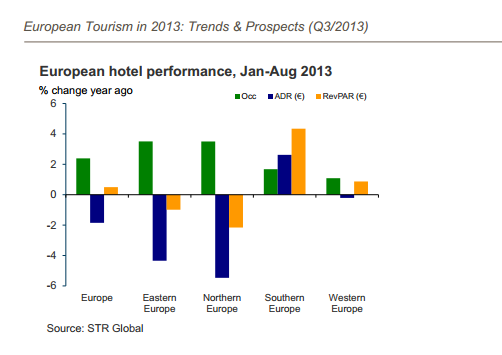

As compared to global hotel demand, Europe is said to have been a clear exception. In 2012, European hotels saw a rather flat performance, but occupancy in hotels have been increasing, with the first eight months of 2013 experiencing a 2.4% increase. An improvement over the 1.8% growth experienced from January through May, indicating acceleration in occupancy and room demand through the summer months.

Occupancy rates in Southern Europe have risen overall, accelerating during the summer months, while Western Europe experienced only a minimal decline. Trends are said to be positive in 20 out of 25 countries, and growth has been reported across all sub-regions through the first nine months of 2013. The statistics for Italy are surprisingly strong, despite a fall in arrivals, which suggests the increase in domestic demand.

Country-specific data reveals that nations with the highest occupancy rates included Slovakia, Poland, Ireland, Lithuania and Italy while the bottom five included Austria, Belgium, Turkey, Estonia and Finland.

Key intra-European Markets

Once again, travel from Germany expanded to most European destinations. Visits from the nation continue to grow, although 8 out of 23 have reported a fall in demand compared to previous year to date. The mixed performance is said to be typified by two of the top destinations for German tourists, with Spain reporting a 4.2% growth in arrivals through August 2013 and Italy reported a 7.1% fall through June of 2013.

French travel demand was more positive later in the year with more destinations reporting that French arrivals and overnight stays were higher in 2012. The U.K. reported strong arrivals, with Lithuania reporting an unusual strong market for French overnights, but weak in terms of arrivals, indicating a trend toward a longer length of stay.

Italian travelers have been staying closer to home. Italian travel throughout Europe has remained fairly weak, with those tourists tending to visit destinations within their own country. This is believed to indicate that these tourists are likely to be seeking to save on costs which may explain the nearly 5% rise in hotel occupancy, while Italy arrivals have fallen.

Summary

Although an uncertain economic backdrop remains, the overall results of 2013 to date indicate a positive year for international tourism. Countries that are proactive in creating targeted campaigns are likely to reap the benefits in 2014.

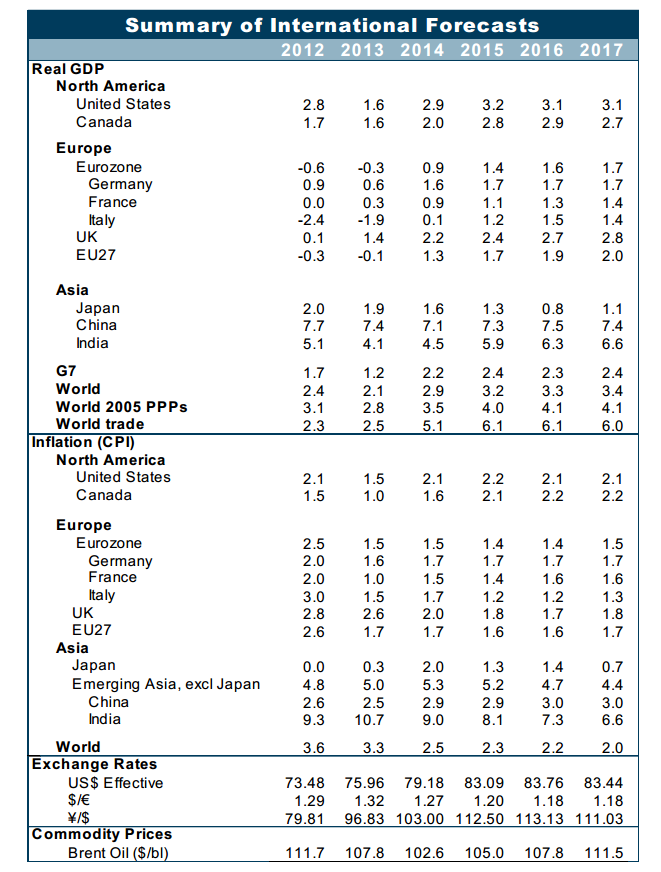

The European Travel Commission notes that there have been encouraging signs that an economic recovery is underway in Europe, with prospects for 2014 pointing to a slow increase in growth pace, predicting 1.4% in the EU and 1.1% in the Euro area.

A quarterly insights report produced for the Market Intelligence Group

of the European Travel Commission (ETC)

by Tourism Economics (an Oxford Economics Company)